Saving money offers numerous advantages, including financial security and peace of mind during times of emergency. It helps you achieve personal goals, reduces reliance on debt, and provides investment opportunities. With better budgeting skills, you can manage finances more effectively and enjoy increased flexibility in your choices. Additionally, savings benefit from compound interest, contributing to long-term wealth accumulation and preparing you for a comfortable retirement. Prioritizing saving empowers you to build a secure financial future.

Let’s explore the tips that will be of so much benefit to a person looking to start saving money:

Table of Contents

Understanding Your Financial Situation

Before initiating any money-saving challenge, it is imperative to have a thorough understanding of your financial situation.

- Create a personal balance sheet – This process begins by creating a personal balance sheet, which is a snapshot of your assets versus your liabilities. By identifying your assets—such as cash savings, investments, and property—and your liabilities, including loans and credit card debt, you can gain clarity on your net worth. This crucial information not only highlights your current financial standing but also informs your future savings plan.

- Track monthly expenses – In addition to the balance sheet, tracking monthly costs is a significant step in understanding your financial landscape. Maintaining a detailed log of your monthly payments can reveal patterns and habits that you may not have been aware of. Categorizing these expenses into fixed and variable costs is beneficial. Fixed costs, such as rent or mortgage payments, are stable each month, while variable expenses, like dining out or entertainment, can fluctuate. Recognizing the distinction between these two types of expenses enables you to pinpoint areas where reductions can be made, ultimately contributing to your overall goal of saving money.

- Understand your income streams – Furthermore, understanding your income sources is vital. Whether your income is derived from a salaried position, freelance work, or investment dividends, having a comprehensive view of your earnings will facilitate more effective budgeting. By knowing the total resources available to you, you can formulate a more realistic savings plan. Emphasizing the importance of saving money through careful analysis of income and expenses lays a solid foundation for future financial success. Taking the time to assess your financial situation will empower you to make informed decisions that align with your savings goals.

Setting Realistic Savings Goals

Establishing realistic savings goals is a fundamental step in any money-saving challenge.

- Adopt the SMART criteria – To effectively enhance your financial health, it’s crucial to adopt the SMART criteria: specific, measurable, achievable, relevant, and time-bound. This approach ensures that your objectives are clear and attainable, which increases the likelihood of success. For instance, rather than stating a vague goal of “saving money,” consider specifying a more concrete goal, such as “saving $1,500 for a vacation by next summer.” This precision not only motivates you to save consistently but also provides a target to strive for, reinforcing the importance of saving money.

- Break down larger savings goals– Moreover, breaking down larger savings goals into smaller, manageable milestones can significantly bolster your motivation. Instead of feeling overwhelmed by the total amount needed, focus on short-term targets such as saving $300 per month. Achieving these small goals creates a sense of accomplishment, encouraging consistent progress toward the larger objective. This technique aligns with behavioral psychology principles, where each small success can lead to increased engagement and commitment to the overall saving strategy.

- Do you want short-term or long-term goals?– It is also essential to categorize your savings goals into short-term and long-term objectives. Short-term goals, like building an emergency fund or saving for a holiday, typically require a timeframe of one year or less. On the other hand, long-term goals may involve saving for retirement or a down payment on a house, which can span several years. Understanding the difference helps in prioritizing which goals to tackle first. For instance, focusing on building an emergency fund as a primary goal may provide immediate financial security while also paving the way for long-term aspirations. Ultimately, setting realistic and structured savings goals fosters a disciplined approach to saving money, providing clarity and purpose to your financial journey.

Creating a Budget That Works

Image by Drazen Zigic on Freepik

Establishing a practical budget is a crucial step in achieving financial stability and saving money. A well-structured budget not only helps you understand your income and expenditures but also serves as a blueprint for reaching your financial goals.

Methods to Effective Budgeting

- 50/30/20 rule– One popular budgeting method is the 50/30/20 rule. This approach allocates 50% of your income to essentials, 30% to discretionary expenses, and 20% to savings and debt repayment. This framework can help you grasp the importance of saving money while ensuring essential needs are adequately met.

- Zero-based budgeting– For those who prefer a more detailed system, zero-based budgeting may be an ideal choice. In this method, every dollar is assigned a specific purpose at the beginning of the month, which means that your income minus expenses equals zero. This technique fosters accountability and enables you to track every cent, thus enhancing your money-saving challenge. Customizing your budget to fit your lifestyle is essential; consider factors such as your income level, family size, and specific financial goals when designing your budget.

In addition to these methods, utilizing budgeting tools can significantly improve your tracking process. There are various apps and spreadsheets available that can simplify expense monitoring and help you maintain financial discipline. Popular applications like:

- Mint,

- YNAB (You Need A Budget), and even

- Google Sheets can provide real-time insights into your spending habits.

By regularly reviewing your budget, you can make adjustments as needed, ensuring that your budget remains an effective tool in achieving financial well-being. The importance of saving money manifests in your ability to make informed decisions about where your funds are allocated, ultimately leading to increased savings and improved financial health.

Identifying Areas to Cut Back

In today’s fast-paced economy, identifying areas to cut back on expenses is a crucial component of a successful money-saving challenge. A thorough review of one’s spending habits will reveal numerous opportunities for saving money.

Strategies to monitor your spending habits

- Assess monthly subscriptions – Begin by evaluating monthly subscriptions, including streaming services, magazine subscriptions, and gym memberships. Many individuals find themselves paying for services they rarely use. Canceling or consolidating these subscriptions can result in immediate and substantial savings.

- Check on impulse buying – Moreover, being mindful of impulse purchases can significantly lower one’s expenditures. It is common to encounter enticing promotions that encourage impulsive buys, but these can rapidly accumulate and erode one’s savings. Establishing a cooling-off period—where one waits 24 hours before making an unplanned purchase—can be an effective strategy to mitigate these expenses. This approach allows individuals to contemplate whether the item is genuinely needed or merely a fleeting desire.

- Explore alternative spending habits – Another effective tactic is to explore alternative spending habits. Consider preparing meals at home instead of dining out, as meals prepared at home are typically less expensive and healthier. Additionally, foregoing expensive coffee shop visits in favor of brewing coffee at home can lead to significant savings over time. Cultivating a habit of tracking expenses through budgeting apps can facilitate a clearer understanding of one’s financial landscape, highlighting areas where savings can be made.

By implementing these practical strategies, individuals can develop a healthier relationship with their finances. Making minor yet thoughtful adjustments to spending behavior can have a profound impact on one’s financial health. Ultimately, recognizing the importance of saving money and consciously making lifestyle changes can foster a more secure financial future.

Utilizing Savings Tools and Resources

In today’s digital age, numerous tools and resources are available to help individuals embark on their money-saving journey. Effectively utilizing these tools can greatly enhance the importance of saving money and make it easier to develop sustainable savings habits.

- High-yield savings account– One highly recommended option is a high-yield savings account. Unlike traditional savings accounts, high-yield accounts typically offer better interest rates, enabling individuals to grow their savings with minimal effort. This means that even small deposits can accumulate more interest over time, amplifying the benefits of saving money.

- Using an automatic savings plan – Another valuable resource for fostering better financial habits is an automatic savings plan. Setting up automatic transfers from a checking to a savings account ensures that a portion of income is consistently saved without requiring constant mindfulness. This strategy aligns with the idea of a money-saving challenge, where individuals aim to save regularly. By automating savings, individuals can enhance their financial well-being and alleviate the stress of manually saving each month.

- Utilizing budgeting apps – Budgeting apps also play a pivotal role in the savings landscape. These applications help users track their expenditures, categorize spending, and set savings goals. Many popular budgeting apps offer regular notifications or reminders, encouraging users to stay on track with their savings goals. Additionally, personal finance blogs and podcasts can serve as invaluable resources, providing tips, insights, and motivation from experts in the field. By integrating technology with finance, individuals can develop a more comprehensive approach to their finances, emphasizing the importance of saving money and promoting a disciplined approach to financial management.

By leveraging these savings tools and resources, individuals can optimize their saving strategies and turn their money-saving challenges into achieving significant financial milestones.

Adopting a Mindset for Saving

Embarking on a money-saving journey requires more than just practical strategies; it also necessitates a fundamental shift in mindset. Developing a saving mindset is essential, as it influences how individuals perceive money and their financial goals.

These tips will help you.

- Recognize that it’s important to save money – Recognizing the importance of saving money is the first step toward financial independence. It is essential to recognize that saving money can significantly improve one’s quality of life, offering security and peace of mind during uncertain times.

- Have discipline– Cultivating discipline is another crucial element in establishing a successful money-saving approach. Discipline helps individuals resist the temptations of consumerism that can derail their financial goals. Instead of succumbing to impulse purchases, cultivating a habit of mindful spending allows one to prioritize savings over unnecessary expenditures. One effective technique is to create a concrete savings goal. Having a specific target, such as an emergency fund or a down payment for a house, can provide clarity and motivation throughout the process.

- Have gratitude for what you possess – Moreover, practicing gratitude To God can serve as a powerful antidote to the pervasive culture of consumerism. By appreciating what one already possesses, individuals can shift their focus from accumulating more goods to valuing their current resources. Regularly reflecting on financial progress, no matter how small, reinforces a positive relationship with money. Recognizing even minor achievements in one’s savings journey, such as successfully adhering to a budget or avoiding a non-essential purchase, fosters a sense of accomplishment and encourages further commitment.

- Stay motivated – Staying motivated throughout this journey is essential. It can be beneficial to visualize the long-term benefits associated with saving money, such as financial security and the ability to pursue personal goals and dreams.

- Engage in money-saving challenges– Engaging in money-saving challenges can also add an element of fun while reinforcing discipline. Here are some envelopes you can give a try.

By integrating these psychological aspects of saving into daily life, individuals can create a robust foundation for their financial future.

Finding Additional Sources of Income

In today’s financial landscape, finding additional sources of income has become increasingly essential for individuals striving to achieve their saving goals. Diversifying income streams not only helps in accumulating funds but also provides a sense of financial security. Engaging in side hustles or freelance work can transform your hobbies and skills into viable revenue streams. There are various avenues one can explore to boost their income, thus enhancing the effectiveness of their money-saving challenge:

- Leverage your existing skills – Firstly, leveraging existing skills can be an effective way to earn extra money. If you possess expertise in areas such as graphic design, writing, or programming, consider offering your services on freelance platforms. Websites such as Upwork, Fiverr, or Freelancer offer opportunities to connect with clients who need specific skills. This not only allows you to generate additional income but also enhances your professional portfolio. Here is a more detailed list of ways to make money at home.

- Look for a part-time job – Besides freelancing, pursuing a part-time job can be another way to augment your income. Retail positions, tutoring, or even remote work options can provide the flexibility needed for those already managing a full-time career. These opportunities can significantly contribute to your overall savings plan, enabling you to save more each month.

- Monetize your hobbies – Additionally, monetizing hobbies can lead to unexpected financial gains. If you have a talent for crafting, cooking, or photography, consider selling your creations or services through online marketplaces or social media platforms. This not only helps generate extra funds but also allows you to engage in activities you are passionate about, making the process more enjoyable.

Engaging in affiliate marketing can also be a very good source of income. This form of marketing requires minimal effort to get started. It is very beginner-friendly. Check out this article to learn more about affiliate marketing.

By seeking out and utilizing these additional income opportunities, individuals can experience the importance of saving money firsthand, making it more feasible to reach their financial objectives.

The Power of Compound Interest

Compound interest is a fundamental concept that plays a pivotal role in the realm of personal finance and wealth accumulation. At its core, compound interest refers to the interest earned on both the initial principal and the accumulated interest from previous periods. This mechanism can significantly enhance your savings over time, making it an essential factor to consider in any money-saving challenge.

Useful illustrations of compound interest

One of the most compelling reasons to start saving money early is the impact of compound interest on your investments. For instance, if you were to invest $1,000 at an annual interest rate of 5% after 10 years, you would have accumulated approximately $1,628. This highlights the importance of saving money early, as the longer your investment has to grow, the more substantial the effect of compound interest becomes. In this scenario, if you delay your investment by just five years, your returns would be reduced to about $1,277, a significant difference attributable to the time value of money.

To further illustrate, consider two individuals: one who starts saving $200 a month at age 25 and another who begins the same savings amount at age 35. Assuming the same 5% annual return, the first individual would have approximately $220,000 by retirement age, while the second would end up with around $135,000. This stark contrast underscores the importance of saving money as early as possible, highlighting how consistency combined with time yields lucrative returns.

As you embark on your money-saving journey, it is imperative to prioritize setting aside funds for retirement and exploring various investment options. High-yield savings accounts, stocks, and mutual funds can all be excellent vehicles for harnessing the power of compound interest. By acting now and committing to a plan, you lay the groundwork for a financially secure future, making every saved dollar work harder for you over time.

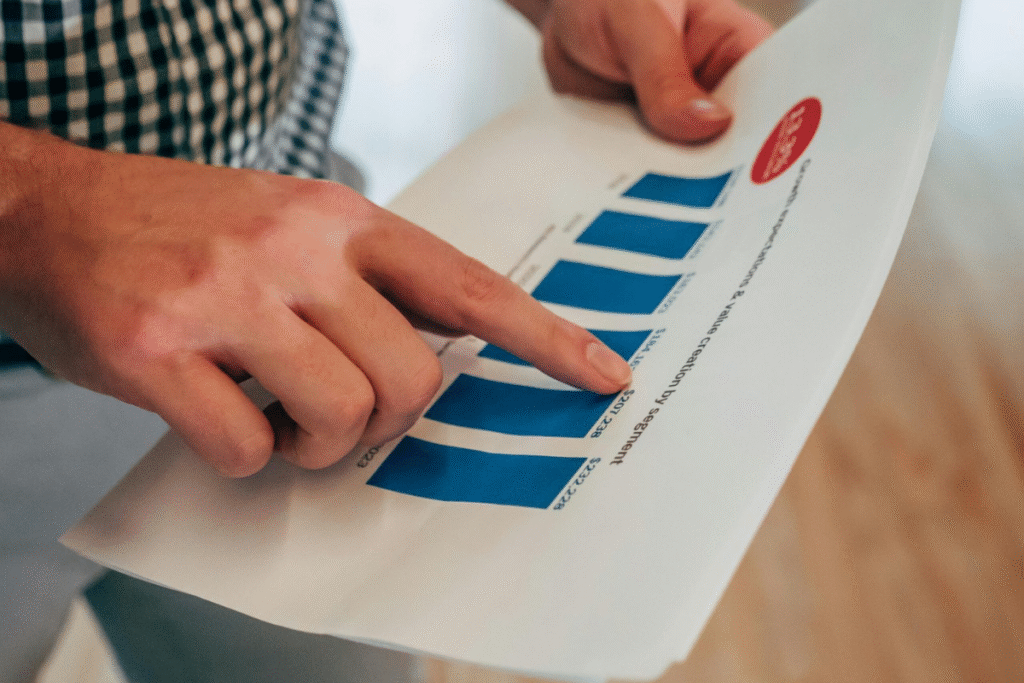

Staying Accountable and Reviewing Progress

Building a robust savings strategy requires not just initiation but also consistent evaluation and accountability.

Key components in achieving effective money-saving habits

- Regular check-ins – One of the key components in achieving effective money-saving habits is the establishment of regular check-ins. These sessions enable individuals to evaluate their progress toward financial goals, assess their budgeting effectiveness, and make necessary adjustments when they encounter challenges. Life is dynamic, and as such, budgets should not be rigid but rather adaptable to changing circumstances.

- Have an accountability partner– An accountability partner can play a pivotal role in this journey. This could be a friend, family member, or even a financial coach who shares similar money-saving challenges. Engaging with such individuals can foster a sense of commitment to the savings plan as they take on an added responsibility to report on progress. Moreover, discussing obstacles and successes with an accountability partner can provide fresh insights and strategies that one may not have considered on their own, amplifying the importance of saving money.

- Celebrate your achievement– As progress is tracked, it is essential to celebrate the milestones achieved, no matter how small. Recognizing these successes not only boosts motivation but also reinforces the positive behavior of saving. Conversely, setbacks are a natural part of the process and should be viewed as learning moments rather than obstacles. By analyzing what contributed to these challenges, individuals can refine their money-saving challenge approaches and emerge more equipped to handle future hurdles.

Ultimately, staying accountable and reviewing progress enables a purposeful saving journey, ensuring that each step taken is a reflection of one’s commitment to financial health. By fostering accountability and remaining adaptable, one can effectively prioritize saving money, leading to long-lasting financial security.

Educating Yourself About Personal Finance

Photo by Mathieu Stern on Unsplash

Educating yourself about personal finance is crucial for anyone looking to take control of their financial future. By learning the basics of budgeting, saving money, and investing, you can make informed decisions that align with your financial goals. Understanding where your money goes helps you identify areas where you can cut back, allowing you to allocate more toward savings and investments.

The Importance of Setting Financial Goals

Setting clear financial goals is a significant step in the journey towards financial literacy. Goals help you stay focused and provide motivation for saving money and spending wisely. Whether your goal is to save for a vacation, buy a home, or invest for retirement, having a plan in place gives you direction and helps you measure progress along the way.

Resources for Personal Finance Education

To enhance your understanding of personal finance, take advantage of the numerous resources available today.

- Online courses,

- Podcasts,

- Books,

- Financial blogs offer invaluable insights into the world of saving money and achieving financial goals.

- Workshops – Additionally, many communities offer workshops that focus on financial literacy, making it easier to enhance your knowledge and skills in this critical area. Investing time in education is a powerful investment in your future.

For summary;

Mastering personal finance is crucial for achieving long-term financial security. By understanding your financial situation and setting realistic savings goals, you can create a budget that works for you and identify areas where you can cut back. Utilize savings tools, adopt a proactive mindset, and explore additional income sources to enhance your financial stability. Recognizing the power of compound interest and staying accountable will help you track your progress. Finally, educating yourself about personal finance empowers you to navigate challenges effectively. Start implementing these strategies today to transform how you save money!

This post contains affiliate links, in which I may earn a small commission when products are purchased through the links at no cost to you. Thank you.